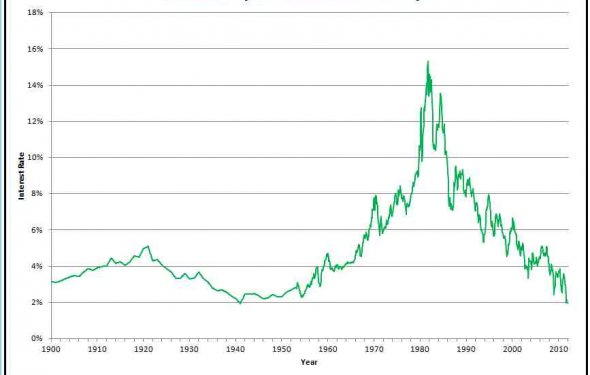

30 year treasury bond rate history

30-year bond futures are part of the financial commodities futures sector in which the contract holder agrees to purchase or sell a bond on a specified date at a predetermined price. Bond contracts are standardized and are overseen by a regulatory agency that ensures a level of equality and consistency. The 30-year bond has long been a favorite of fixed income market participants seeking to match assets to future liabilities. It serves as an important benchmark by which other long-dated securities are measured.

History

Futures on the 30-year U.S. Treasury bond originated at the Chicago Board of Trade (CBOT). The CME Group took over those contracts when the Chicago Mercantile Exchange (CME) acquired the CBOT in 2007. 30-year bond futures at the CBOT where introduced in August of 1977. The Treasury suspended issuing 30-year bonds for several years, starting in October 2001, after four years of rising budget surpluses. The government's fiscal condition worsened after the Sept. 11, 2001 attacks, but forecasters expected any dip into deficit would be short-lived. However, the popularity of long-term investments returned, and the 30-year Bond Futures contract or “long bond” returned in 2006.

Facts

30-year bonds, issued by the United States Department of the Treasury, used to be the bellwether U.S. bond. Now, most consider the 10-year Treasury to be the benchmark. The 30-year Treasury will generally pay a higher interest rate than shorter Treasuries to compensate for the additional risks inherent in the longer maturity. When compared to other bonds, Treasuries are considered safe-haven investments because they are backed by the U.S. government.

Trading

- 30-year bond futures are highly sensitive to global events, conflict, oil and gold futures prices, and fluctuations in the U.S. dollar.

- The CBOT offers futures on 2-year, 5-year and 10-year U.S. Treasury notes as well as 30-year U.S. treasury bonds.

- 30-year bond futures are traded on the Chicago Mercantile Exchange Globex platform.

- 30-year bond futures contract has, at its base, a basket of 30-year government bonds, but they do not all mature 30 years from now. In March 2011, the CME split the 30-year U.S. Treasury bonds into two bonds: CME Group U.S. Treasury Bond, which has a remaining term to maturity of at least 15 years but less than 25 years, and CME Group Ultra U.S. Treasury Bond, with a remaining term to maturity of more than 25 years.

- Front months for 30-year bond futures are June, September and December.

Contract Specifications

| Contract Symbol | Contract Unit | Price Quotation |

| ZB | $100, 000 | dollars per contract |

| Trading Exchange | Trading Hours | Tick Value |

| CME GLOBEX | 17:00 - 16:00 |